£122.000 Bank Error: How One Man Got to “Keep” the Money

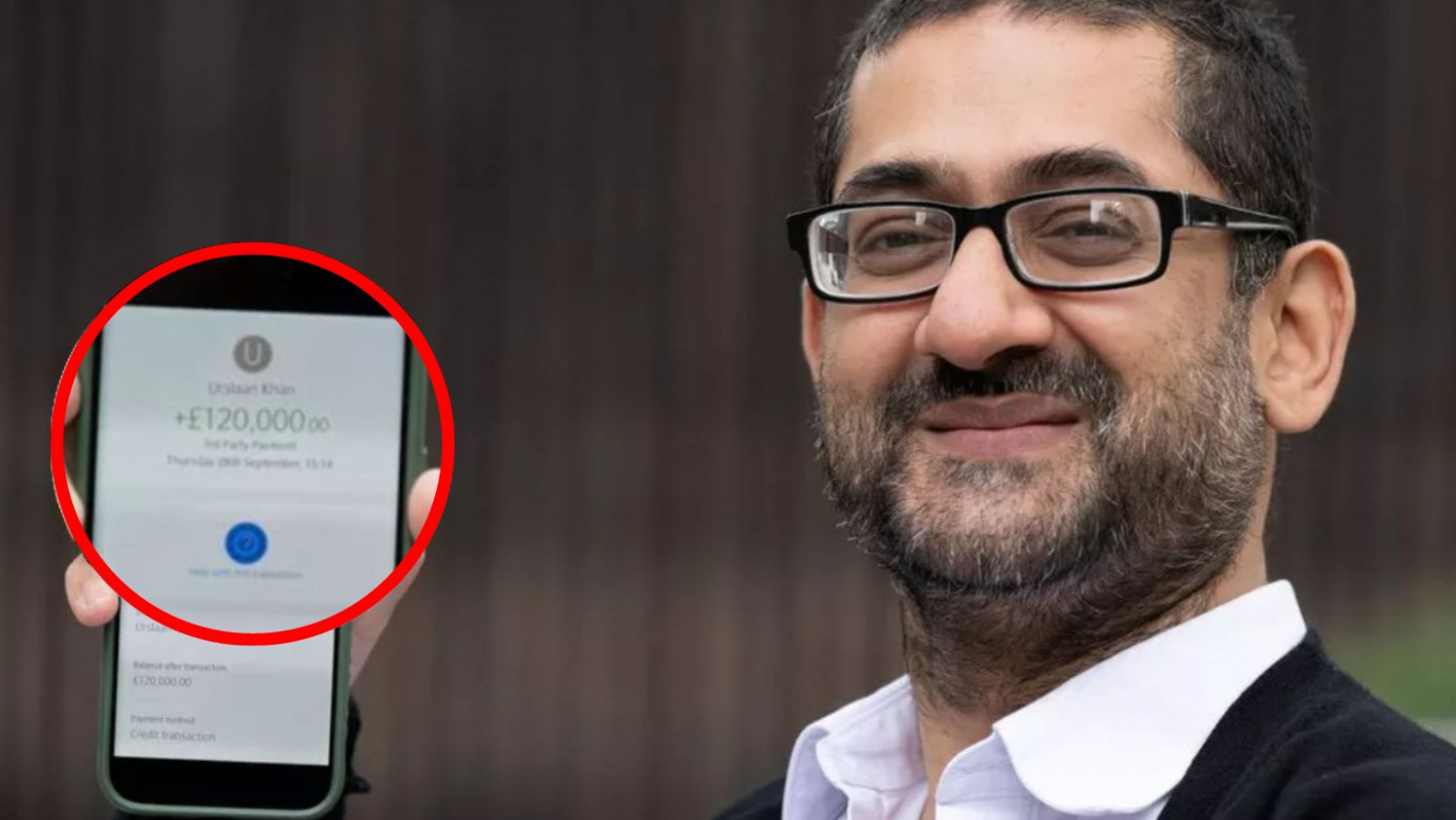

© SWNS

What would you spend a jackpot on? Would you tell your family or friends? Or, would you keep it a secret to yourself? That amount of money can definitely be helpful for maintaining a solid lifestyle. But, what would you do if you won money in error? Would you let authorities know, or would you keep it? While you might think the better option is the latter, this man is here to prove you wrong. A man, even though faced with a £122.000 Bank Error, reported it to authorities and was told he could keep the money! Well, kind of. Here is the full story of this lucky guy.

The £122.000 Bank Error

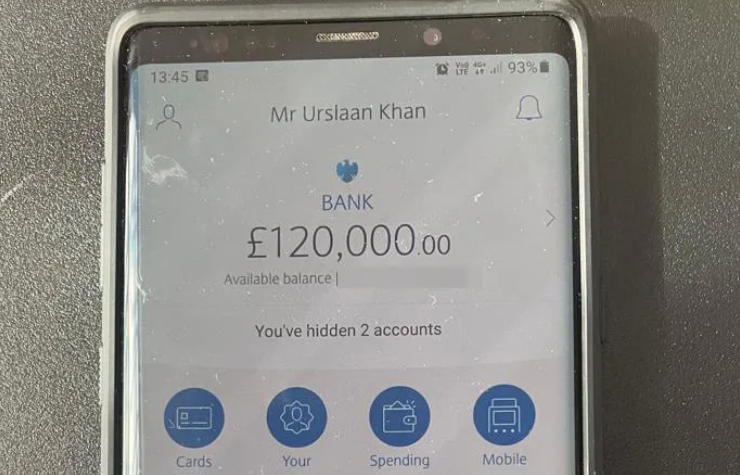

Urslaan Khan, a 41-year-old admin assistant from Poplar, east London, experienced quite the financial shock when he discovered £122,000 unexpectedly deposited into his bank account. This surprising windfall appeared overnight, turning his formerly meager £1 balance into a substantial six-figure sum.

Rather than attempting to hide or spend the unexpected wealth, Urslaan acted responsibly and immediately reported the issue to Gatehouse Bank. In a surprising turn of events, the bank initially confirmed that the money was indeed his and that he could keep it.

However, this story took a twist as the bank subsequently realized its error. Only a day after granting Urslaan access to the substantial sum, they contacted him, requesting the return of the funds.

Recognizing the ethical and legal obligation to return the money, Urslaan Khan dutifully repaid the full £122,000 to the bank on Monday, October 2, illustrating a commendable sense of responsibility and honesty in handling this unexpected financial hiccup.

How Did This £122.000 Bank Error Happen?

To his astonishment, he discovered that the transaction had gone through, increasing his account balance to a substantial £122,000. Even more surprising, the bank permitted him to transfer this sizeable sum to his Barclays account.

Urslaan Khan believes that this significant deposit was initially intended for another customer who had at least two accounts with the same bank. According to his theory, the bank should have moved money from one account (Account A) to another (Account B). However, a mishap in the banking process led to the funds ending up in his account, which he humorously refers to as “Account Z.”

Upon discovering this unexpected financial boon, Urslaan Khan promptly contacted the bank to report the issue. Following a conversation with the bank, he adhered to his moral and legal obligation and returned the entire sum.

What Would Have Happened if He Kept It?

Urslaan emphasized his proactive approach in informing the bank about the situation, recounting that he had been put on hold three times during the communication process and was initially reassured that the funds were rightfully his. However, the bank realized their mistake 24 hours later, acknowledging that the transfer was made in error without his request. Had Urslaan decided to spend the money knowingly, he could have potentially faced legal repercussions for handling funds that weren’t rightfully his.

What would you do in this situation? Do you agree with Mr. Khan’s decision? Let us know what you think in the comments below!

You might also want to read: How to Save Money 101: Easiest Budgeting Tips