Third-Grade Teacher Money Rent System Goes Viral

©️ Freepik

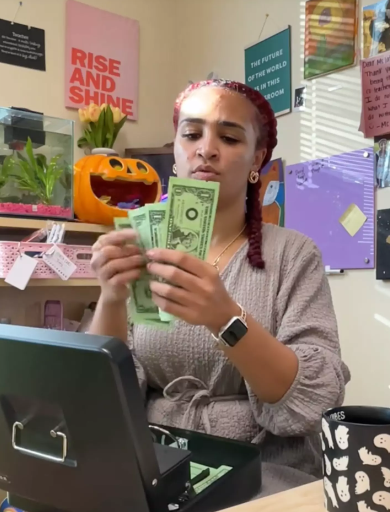

A third-grade teacher from Charlotte, North Carolina, has implemented a unique system in her classroom charging students “rent money.”

She has done this to teach her students about financial literacy. This unconventional method has gained significant attention on social media, particularly TikTok, where her videos have amassed millions of views and likes.

Third-Grade Teacher Charges Money for Rent

This very special third-grade teacher approach involves charging her students “rent money” for their desks and other classroom essentials.

Although the rent is paid with fake money, the lessons are very real. Each student must pay $7 in classroom currency weekly, covering items like desks and pencils. To earn this money, students take on various classroom jobs, such as teacher’s assistant, line leader, door holder, recess basket handler, lunch basket handler, and cleanup crew.

These jobs come with different pay scales based on their frequency and responsibility.

Real-World Lessons

In one viral TikTok video, Lattimore is seen reminding her students about their rent payment day. She emphasizes the importance of saving and budgeting, mirroring real-world financial responsibilities.

Students can use their earnings to buy rewards such as candy, homework passes, lunch with a friend, or even lunch with Ms. Lattimore herself. The most coveted reward, “being a teacher for a day,” costs $30.

Lattimore explained to NBC News, “The jobs that are every day, like line leader and teacher assistant, get paid more than jobs that are less frequent. This system teaches them the value of money and the need to budget wisely.”

Social Media Sensation

Lattimore’s teaching method has not only engaged her students but also captured the interest of a global audience. Her TikTok account has garnered over 870,000 followers and more than 27 million likes.

Through her videos, Lattimore shares insights into her classroom economy and the positive impact it has on her students.

While many praise her for instilling valuable life skills at a young age, some critics argue that third grade is too early to introduce financial worries. Despite the mixed reactions, Lattimore remains committed to her approach, believing it provides her students with essential knowledge for their futures.

Impact on Students and Community

Lattimore’s classroom economy is particularly significant given the demographic of her students. Many come from families facing financial difficulties.

“A lot of my kids come from families that live check to check and are not in the best financial situation,” she shared. “I don’t think they’re too young to ever learn how to handle money, how to use money, and how they want to use their money.”

Parents have also seen the benefits of Lattimore’s method. Brittany Sales, a parent of one of Lattimore’s students, noted the positive changes in her daughter’s understanding of money management. “She just thought it grew on trees and she could spend it. We learned so much from how she taught it.”

Beyond the Classroom

The success of Lattimore’s teaching method extends beyond the classroom. She has monetized her TikTok content and collaborated with brands, earning six figures from her online presence—an income significantly higher than her teaching salary. However, Lattimore’s primary motivation remains the impact on her students. “It’s going to sound so corny, but it’s them,” she said, referring to her students as her source of inspiration.

Money Management: Teaching Your Kids the Value of a Dollar

Financial literacy is the broader term, encompassing knowledge, skills, attitudes, and behaviors related to money. It’s about understanding financial concepts, like budgeting, saving, investing, and debt management.

Money management is a specific application of financial literacy. It’s about using financial knowledge and skills to make practical decisions about money, like creating a budget, saving for goals, and making wise spending choices.

Money management is a lifelong skill. Starting early gives your child a head start on financial savvy. But where to begin?

Start Young

Even young children can grasp basic money concepts. Introduce them to coins and bills, explaining their values. Use simple language to differentiate between needs (food, clothing) and wants (toys, treats). Read stories or watch shows that incorporate money lessons in a fun way.

Make it Tangible

Piggy banks: A classic for a reason! Physical money is easier for kids to understand. Use piggy banks to visualize savings growth.

Chore charts: Create a chore chart with clear rewards, teaching the connection between effort and earnings. Link earnings to tasks, teaching responsibility, and the value of hard work.

Family budgeting: When appropriate, involve children in family budgeting discussions, explaining income, expenses, and saving for goals. Involve older kids in age-appropriate ways. Let them see where the money goes.

Foster Good Habits

Delayed gratification: Help them understand the power of waiting for something special.

Saving goals: Encourage them to save for specific items, breaking down larger goals into smaller steps. Set short-term (a new game) and long-term (a bike) savings targets.

Charitable giving: Teach compassion by encouraging donations to a cause they care about. Cultivate empathy by involving kids in choosing a charity and donating a portion of their savings.

Talk About Money Openly

Be honest and transparent about family finances, using age-appropriate language. Discuss everyday money situations like shopping, saving for vacations, or paying bills. Introduce concepts like interest, inflation, and investing in a simplified way as your child grows older.

It’s about more than just numbers. You are building confidence, responsibility, and a strong financial future for your child.

Shelby Lattimore’s innovative approach to teaching financial literacy has sparked a broader conversation about the importance of money management education at a young age. While opinions may differ, the positive feedback from students and parents highlights the potential benefits of such creative teaching methods.

As financial literacy becomes an increasingly vital skill, educators like Lattimore are paving the way for future generations to navigate the complexities of money management.

You may also like: How to Save Money 101: Easiest Budgeting Tips