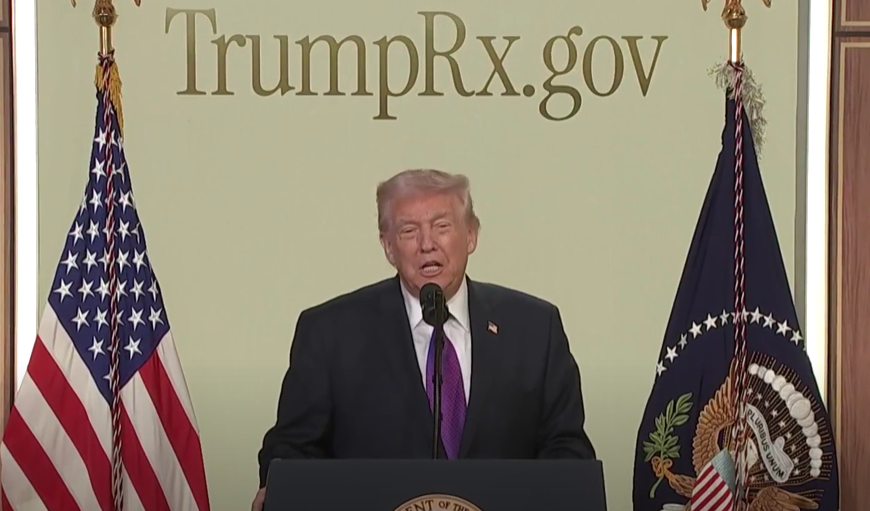

Donald Trump Reverses Course on Student Loan Forgiveness

© Kathy Hutchins / Vecteezy

The Trump administration has announced a major update to federal student loan policy — reinstating loan-forgiveness processing for millions of borrowers after months of delays and legal battles.

The move comes after a lawsuit by the American Federation of Teachers (AFT) forced the government’s hand, reigniting relief efforts tied to income-based repayment (IBR) and related programs.

The U-Turn: What Changed

Earlier in the year, the Department of Education paused processing of loan forgiveness under key repayment plans, including IBR, ICR (Income-Contingent Repayment), and PAYE (Pay As You Earn). The freeze left many eligible borrowers in limbo.

Under the new agreement, the administration has committed to resume discharges for those who have made enough qualifying payments. Specifically:

- Borrowers enrolled in IBR or other income-driven plans will now have their forgiveness processed.

- The date of eligibility for forgiveness will now be retroactive to when they first qualified, helping many avoid surprise tax bills tied to debt cancellation.

- The phase-out of some existing programs (like ICR and PAYE) is now set for July 2028, making this relief window urgent.

Why It Matters — And What’s At Stake

For millions of student-loan borrowers, especially those in public service, nonprofit jobs, or income-linked payment plans, this update offers real hope:

- Long-standing payment-to-forgiveness timelines (20-25 years) may finally result in discharge for those eligible.

- The tax exemption that applies to canceled student debt is set to expire after December 31, 2025 — so timing matters.

But the relief is not universal:

- Many borrowers under the SAVE plan or other newer repayment options remain subject to legal and administrative delays.

- Eligibility rules still apply: you must be enrolled in a qualifying plan, have completed the required number of payments, and meet other criteria.

What Borrowers Should Do Now

If you have federal student loans, here are the key steps:

- Check your repayment plan: Log in at StudentAid.gov and verify whether you’re enrolled in IBR, ICR, or PAYE and how many qualifying payments you’ve made.

- Watch for eligibility notices: The Department of Education is sending emails to borrowers it believes are eligible for discharge.

- Decide whether to opt-out: Some notices give you the option to refuse discharge — if you prefer to continue paying rather than be forgiven now (for tax or personal reasons), you may opt-out.

- Seek advice: Consider consulting a financial advisor or student-loan counselor if you’re uncertain about your plan, eligibility status or tax implications.

The Takeaway

The Trump administration’s shift here signals a broader recalibration of student-loan policy — one that re-opens relief pathways paused earlier. While not a universal cancellation for all borrowers, the action offers a lifeline for many who believed forgiveness was indefinitely stalled. If you’re tied to a qualifying plan and have made the required payments, this is a moment to check your status and act — because timing and eligibility now make a difference.

You might also want to read: Gaza Peace Signed, But Many Key Questions Remain