Bitcoin Whale Wakes Up After 14 Years, Moves $8.6 Billion in BTC

© David McBee / Pexels

In a move that shocked the crypto world, a long-dormant Bitcoin wallet—active last in 2011—has suddenly transferred 80,000 BTC, worth an estimated $8.6 billion today.

The transaction, split across eight wallets, marks one of the largest known movements of Bitcoin. Yes, that is from the early days of the network.

This wallet, believed to belong to an early miner or investor, dates back to the time when Bitcoin was valued at less than $1. At the time of acquisition, the BTC in question would have been worth just around $200,000.

Record-Breaking Crypto Transfer

Analysts say this is the largest on-chain Bitcoin movement in history from a so-called “Satoshi-era” wallet. Each of the original addresses transferred 10,000 BTC, sparking widespread speculation about the motive behind the move.

What’s notable is that the destination wallets were also non-custodial, meaning the coins weren’t sent to an exchange. This suggests the transfer wasn’t made for selling purposes, but likely for enhanced security or consolidation.

Not a Crypto Sell-Off—At Least Not Yet

While sudden whale activity often triggers panic selling or price swings, this particular transfer hasn’t impacted Bitcoin’s market price dramatically. Experts believe this is because the BTC hasn’t been listed for sale or moved to any known exchange wallets. The coins are currently just sitting in newly created private addresses.

This strategy is commonly seen among high-net-worth holders who prefer to store their assets in upgraded or multi-signature wallets for additional protection.

Who’s Behind the Crypto Wallet?

As with many early Bitcoin wallets, the identity behind this whale remains a mystery. Given the timing and amount, some speculate it could be a very early miner. They say it is possibly even someone connected to Bitcoin’s mysterious creator, Satoshi Nakamoto. But there’s no concrete evidence supporting that theory.

Others believe the move could be linked to legal matters, inheritance planning, or a calculated preparation for OTC (over-the-counter) trading, which wouldn’t disrupt the market the same way a public exchange dump would.

What It Means for Bitcoin’s Future

This transfer reinforces one key aspect of Bitcoin’s appeal: its longevity. That someone can access and move coins untouched for over a decade is a testament to the resilience of blockchain technology.

It also reminds the crypto community that some of the largest holders remain silent—and that their actions, even after years of inactivity, can ripple across markets instantly.

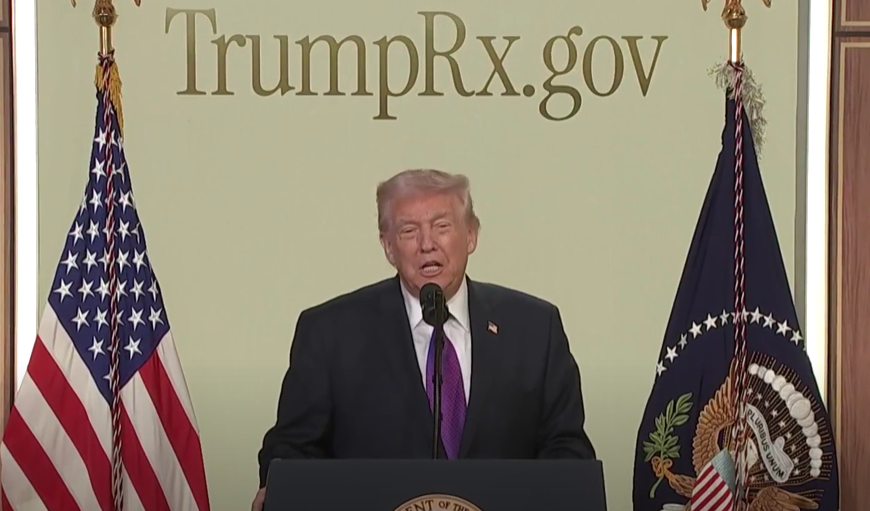

You might also want to read: What Did Trump Say About Crypto That’s Got Everyone Talking?