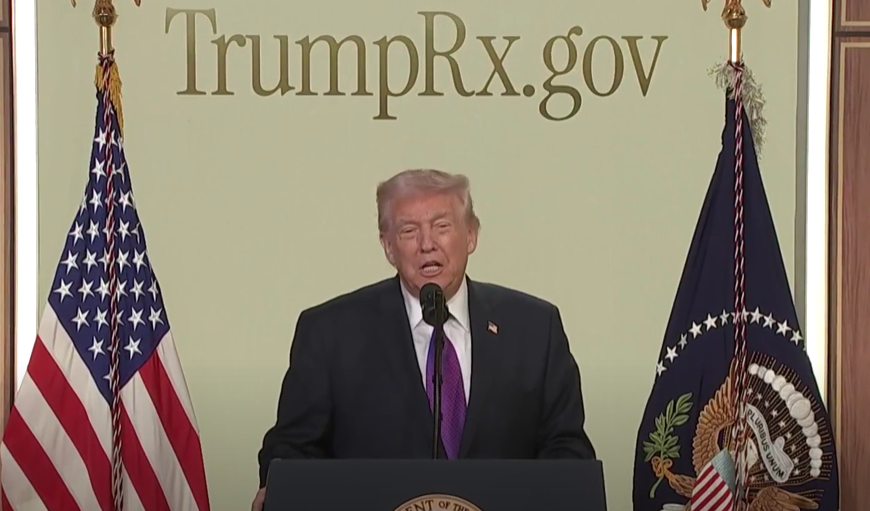

Dell Pledges $6.25 B to Fund “Trump Accounts” for 25 Million Kids

© NBC News

Michael and Susan Dell announced they are donating $6.25 billion to support the new “Trump Accounts,” a financial-savings scheme for children created under the recent legislation signed by Donald Trump.

What’s Going On: The Dell Gift

Under the program:

- The U.S. Treasury will provide $1,000 seed money for every child born between 2025 and 2028.

- The Dells’ donation will provide $250 deposits into accounts for roughly 25 million children aged 10 or under who were born before the 2025-2028 window — children who wouldn’t otherwise qualify for the federal $1,000.

Their goal, as they stated, is to offer more American children a “stake in American prosperity,” by giving them a financial head-start invested into index funds, convertible to cash when they turn 18 — for college, first home, business startup, or other major expenses.

The Dells described it as “hope and opportunity for generations to come.”

Trump Accounts & How They Work

- Eligibility: Any U.S. child with a Social Security number. For federal funding: children born 2025–2028. For the Dell donation: children 10 or under born before 2025, especially in lower- or middle-income ZIP codes (median household income ≤ $150,000).

- Funding & Growth: The initial funds are invested in index funds tracking the overall stock market. Families, employers, and other donors can contribute later — up to certain annual limits.

- Access: Funds locked until the child turns 18 — then available for education, home purchase, business start-up, etc.

The Dells hope that by seeding so many accounts, they’ll encourage more families and employers to contribute over time, maximizing long-term growth.

Support & Skepticism: Praise Meets Critique

What Supporters Say:

- The pledge is possibly “the largest single private commitment made to U.S. children”.

- It could offer many children — especially those from under-resourced neighborhoods — a real head start toward financial stability: college, home-ownership, or entrepreneurship.

- The combination of government seed money + private donation + later family/employer contributions mimics long-discussed “baby-bond” ideas — giving every child some capital from the start.

What Critics Warn:

- The benefit might be modest: a $250 start plus stock-market growth may not offset the deep-rooted issues of poverty or inequality. Some argue it doesn’t replace more direct social supports like child care, food, or health assistance.

- Since the investments are in index funds, returns depend on stock-market performance and additional contributions — meaning families with more resources Get More Benefit, possibly reinforcing wealth gaps.

- The accounts don’t “solve” immediate poverty: funds are locked until 18, so children growing up now still face day-to-day hardship without immediate support.

Why It Matters — Big Stakes for Millions of Kids

This pledge and program mark a major shift: it attempts to institutionalize a kind of universal savings-account model for children — combining government seed money, private philanthropy, and long-term investment.

If broadly adopted and supplemented over time, “Trump Accounts” might redefine how Americans build long-term financial opportunity from birth, potentially shrinking inequality over decades.

At the same time, the controversy around policy cuts (childcare, social safety nets) means many see this as a partial — possibly insufficient — substitute for systemic support.

How this plays out could shape — for a generation — educational access, home-ownership rates, and economic mobility for millions of U.S. children.

You might also want to read: White House Says Trump’s MRI Scan Was “Perfect”