‘No Tax on Tips’ Law Expands Across Industries

© Sam Dan Truong / Unsplash

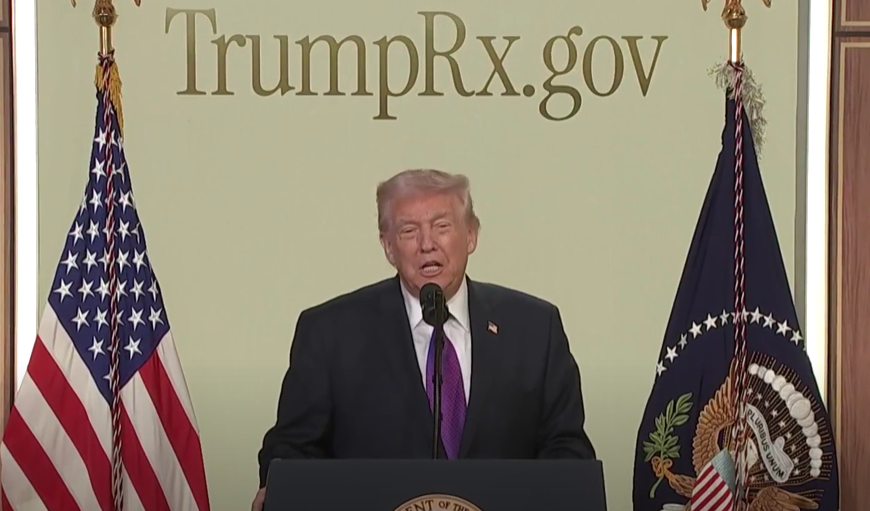

As part of the landmark “One Big Beautiful Bill” signed into law on July 4, 2025, the U.S. government is phasing in a sweeping tax deduction: up to $25,000 in tipped income per year is now tax-exempt for eligible workers in traditionally tip-dependent professions.

Who Qualifies? An Expanding List

Initially, hospitality workers like bartenders, chefs, and hotel staff were included.

However, the law has since broadened to cover a wider array of roles—such as DoorDash and Uber delivery drivers, home service providers (e.g., plumbers, electricians, landscapers), digital content creators (streamers, podcasters, influencers), entertainers and event staff, and even tradespeople like massage therapists and tattoo artists.

How It Works & Eligibility Details

This is structured as a federal income tax deduction rather than an exclusion, meaning it reduces taxable income. It applies regardless of whether a taxpayer claims the standard deduction or itemizes.

The benefit is designed to phase out for higher earners—single filers above $150,000 and couples above $300,000 may see reduced or eliminated benefits. Employers get credits for payroll taxes on tipped income, and the provision is retroactive to 2025. It’s set to expire after 2028.

Who Stands to Benefit—and Who Might Not?

Roughly 4 million workers—about 2.5% of the U.S. workforce—are estimated to qualify. Advocates argue this is a much-needed boost for service and gig workers. One delivery driver noted the savings could help cover medical costs or allow more family visits. On average, tipped workers might gain around $1,300 annually in take-home pay.

However, critics point out that many low-income tipped workers already pay little to no federal income tax, making the deduction less impactful. Moreover, program cuts to Medicaid and SNAP may erode these gains, raising concerns that the broader fiscal consequences may outweigh benefits.

Broader Implications and Criticism

Critics also warn that the change could distort labor practices, encouraging more reliance on tipping rather than fair wages, and muddy record-keeping. Concerns about reduced tip amounts have been voiced, and questions linger about how service workers might verify or document tip income to benefit from deductions.

Some experts caution that the shift may deepen economic inequity—benefiting a select few while neglecting broader wage and social welfare reforms.

You might also want to read: Family Sues OpenAI After 16-Year-Old’s Suicide