4 Million Signups for Biden’s Student Loan Debt Relief

© joebiden / Instagram

We are definitely no stranger to the huge student loan debts that Americans are facing on a daily basis. To counter the issue, Biden is offering student loan debt relief that will help students all over the U.S. With the announcement, came a lot of support. And students were more excited to apply for loan debt relief. Here’s how many people signed up for the program.

Biden’s Student Loan Debt Relief Program

The Biden administration’s new student loan repayment plan is called the Saving on a Valuable Education (SAVE) plan. Additionally, it has garnered 4 million enrollees in the two weeks since its launch in late July. This income-driven repayment program aims to lower monthly payments for about 20 million borrowers by tying payments to their income. The plan was created to address issues in existing plans, such as interest accumulation. Most of the 4 million enrollees were transferred from the earlier REPAYE program. However, an additional 1 million borrowers have applied for SAVE since it became available for applications in the summer.

This new plan is being implemented as student loan repayments resume after a three-year pause due to the COVID-19 pandemic, and it comes a month after the Supreme Court blocked President Biden’s student loan debt cancellation plan to forgive up to $20,000 in student debt. Moreover, interest started accruing again on September 1, and monthly payments are set to restart in October for borrowers.

How Can You Sign Up For Biden’s Student Loan Debt Relief?

The SAVE plan application can be found on the Federal Student Aid income-driven repayment plan website. Furthermore, this new plan is replacing the REPAYE plan, and borrowers currently on REPAYE will be automatically moved to the SAVE plan.

What Amount Can You Expect To Be Forgiven?

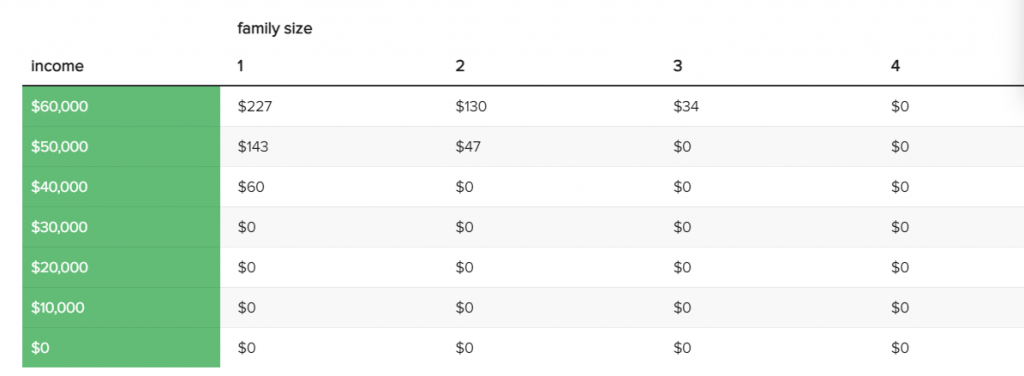

Borrowers under the SAVE plan have the potential to reduce their monthly payments significantly, with some even having payments cut in half or reduced to $0. The Biden student loan debt cancellation program’s savings can amount to up to $1,000 annually for many participants, as it is structured based on income and family size, with lower-income households with more family members paying the least.

Under the new SAVE plan, the monthly payments depend on factors such as family size and income. For a household with four family members earning $60,000 annually, the monthly payment would be $0. In contrast, a one-person household with the same income would pay $227 per month, as stated by the Education Department.

Are You Eligible for SAVE?

The SAVE plan is open to borrowers with direct loans in good standing. Eligible loans for the plan include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans for graduate or professional students, and Direct Consolidation Loans that do not repay any parent PLUS loans. Other loans can qualify if they are consolidated into a Direct Consolidation Loan.

These loans include Subsidized and Unsubsidized Federal Stafford Loans from the FFEL Program, FFEL PLUS Loans for graduate or professional students, FFEL Consolidation Loans that did not repay parent PLUS loans, and Federal Perkins Loans. Some loans are not eligible for the SAVE plan, including Direct PLUS Loans for parents, Direct Consolidation Loans that repaid parent PLUS loans, FFEL PLUS Loans for parents, FFEL Consolidation Loans that repaid parent PLUS loans, and any loans in default.

Will you be applying to the SAVE program?

You might also want to read: UK University Offers A Magic & Occult Degree Now!